a Financial Wellness Benefit that Punches Debt in The Face

Help your team break free from debt and regain focus at work

Increases productivity & focus

Reduces 401(k) hardship withdrawals

Decreases payroll garnishments

Boosts retirement readiness

Decreases pay advance loans

Assists in employee retention

a Financial Wellness Benefit that Punches Debt in The Face

Help your team break free from debt and regain focus at work

Increases productivity & focus

Reduces 401(k) hardship withdrawals

Decreases payroll garnishments

Boosts retirement readiness

Decreases pay advance loans

Assists in employee retention

A Benefit to Lower Their Monthly Payment Stress & Debts

Legally, Simple & Efficiently

A Benefit to Lower Their Monthly Payment Stress & Debts

Legally, Simple & Efficiently

(1)

Tell Us About Your Debt

Talk to one of our Debt Specialist to discuss what is most concerning to you about your debt.

(2)

Discover Your Savings

Find out how to lower your monthly debt payments, save on time and get you on a customized strategy.

(3)

Execute Debt Relief & Solutions

Work with our network of experts and professional to get your strategy executed towards to your debt-free life.

Average Reduction of 40% & Years Off Debt Terms

(1)

Tell Us About Your Debt

Talk to one of our Debt Specialist to discuss what is most concerning to you about your debt.

(2)

Discover Your Savings

Find out how to lower your monthly debt payments, save on time and get you on a customized strategy.

(3)

Execute Debt Relief & Solutions

Work with our network of experts and professional to get your strategy executed towards to your deft free life.

Average Reduction of 40% & Years Off Debt Terms

If your employees are struggling with this type of debt,

we’re here to help!

Credit

Cards

Medical

Bills

Private Student Loans

Cash Advance Loans

Commercial Banks

Solar

Panels Financing

Merchant Cash Advance

Furniture

Loans

Payday

Loans

Business

Debts

Credit

Unions Loans

Time

Shares

Department Store

Accounts

State & Fed

Taxes

Gas

Cards

If your employees are struggling with this type of debt, we’re here to help!

Credit

Cards

Medical

Bills

Student

Loans

Cash Advance

Loans

Commercial

Banks

Solar Panels Financing

Merchant Cash Advance

Furniture

Loans

Credit

Unions Loans

Payday

Loans

Business

Debts

Time

Shares

Department Store Accounts

State & Fed

Taxes

Gas

Cards

The Real Costs of Employee's Financial Stress

68% of American workers experience financial stress, with those under 30 at 78%.

Debt and unexpected costs affect overall well-being and performance.

Debt and Unexpected Costs

Financial struggles create stress, affecting employees’ health, productivity, and focus.

Health Issues and Absenteeism

Stress-related health problems lead to more frequent sick days, increasing absenteeism.

Distractions and Reduced Productivity

Financial worries cause distractions, reducing employee efficiency and increasing errors.

The Real Costs of Employee's Financial Stress

68% of American workers experience financial stress, with those under 30 at 78%.

Debt and unexpected costs affect overall well-being and performance.

Debt and Unexpected Costs

Financial struggles create stress, affecting employees’ health, productivity, and focus.

Health Issues and Absenteeism

Stress-related health problems lead to more frequent sick days, increasing absenteeism.

Distractions and Reduced Productivity

Financial worries cause distractions, reducing employee efficiency and increasing errors.

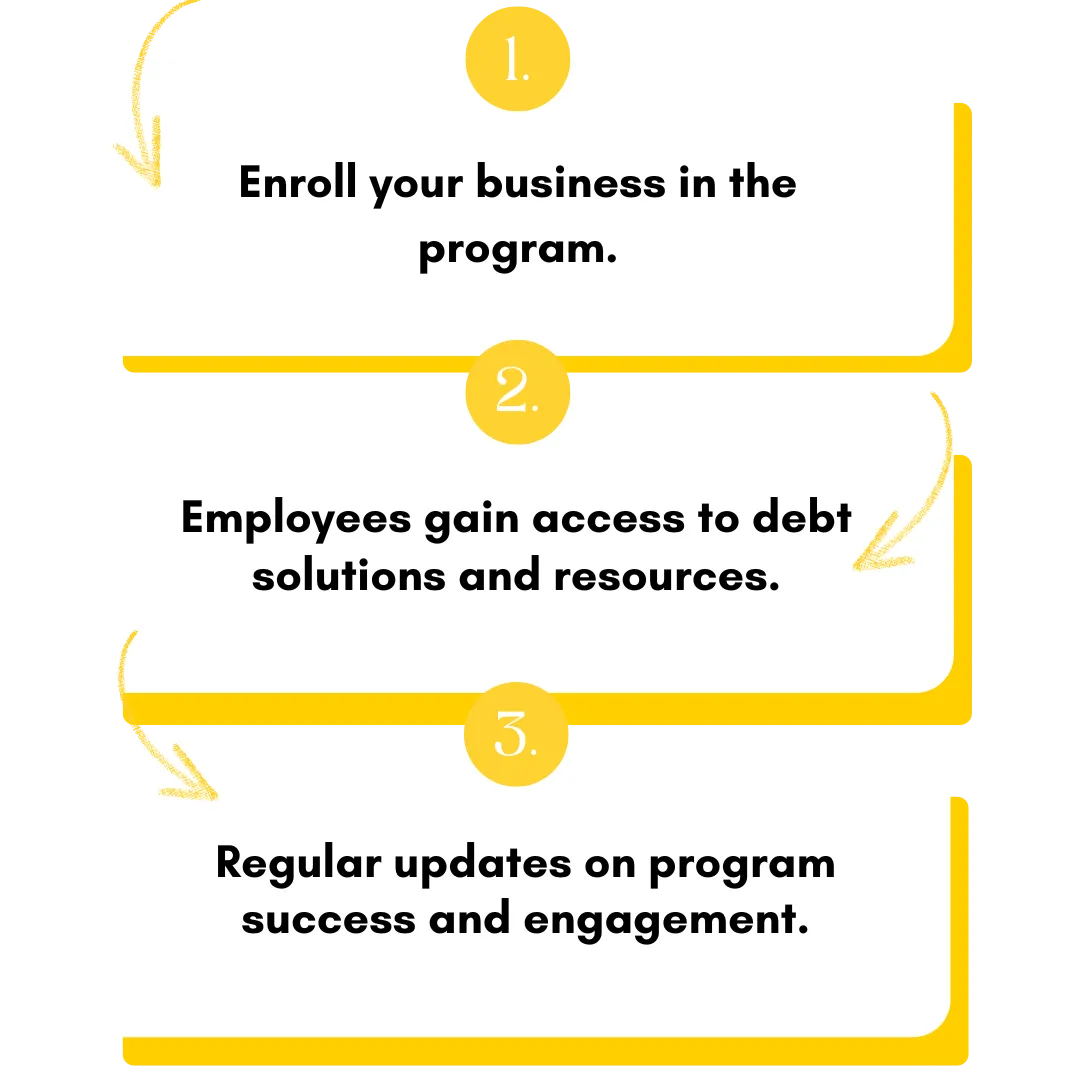

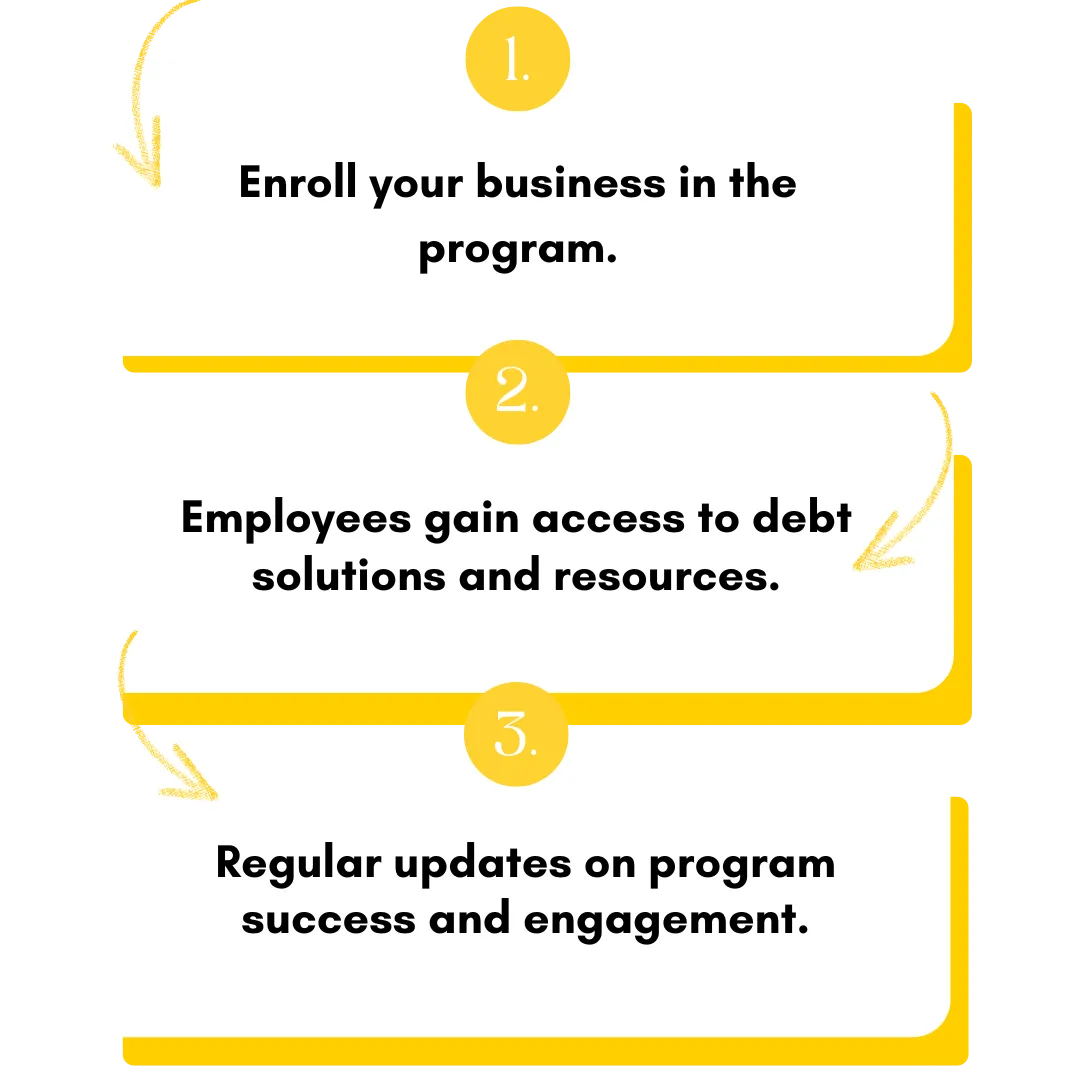

3 Simple Steps to Empower Your Employees

We Equip Your Employees with Tools to Eliminate Debt, Reduce Stress, and Stay Focused on Their Work.

3 Simple Steps to Empower Your Employees

We Equip Your Employees with Tools to Eliminate Debt, Reduce Stress, and Stay Focused on Their Work.

Program Benefits for Employers

BI-LINGUAL IN OVER 20 LANGUAGES

Employees burdened by debt are less focused and more likely to leave.

If they have over $7,000 in unsecured debt—like medical bills, credit cards, or student loans—we can possibly reduce payments by 40-60%, putting them back on track financially. This is a legal solution, not an educational course, to solve the problem and help your team thrive.

Program Benefits for Employers

Employees burdened by debt are less focused and more likely to leave.

If they have over $7,000 in unsecured debt—like medical bills, credit cards, or student loans—we can reduce payments by 40-60%, putting them back on track financially. This is a legal solution, not an educational course, to solve the problem and help your team thrive.

BI-LINGUAL IN OVER 20 LANGUAGES

Financial stress has made its way into the workplace in more ways than many of us may realize.

But don’t worry—we’ve got the solutions!

Financial stress has made its way into the workplace in more ways than many of us may realize.

But don’t worry—we’ve got the solutions!

Let us handle the stress so your team

can focus on success

Let us handle the stress so your team

can focus on success

DEBT IS TEMPORARY, IT IS NOT AN IDENTITY!

DEBT IS TEMPORARY, IT IS NOT AN IDENTITY!