Why Closing Credit Cards Can Hurt Your Credit Score

Closing a credit card can feel like progress, but it may quietly lower your credit score. Learn how utilization, credit age, and timing affect your score before you close an account.

Explore practical tips, real success stories, and expert insights on debt relief, credit repair, and financial freedom. My Debt Navigator helps you take control of your money and confidently move toward a debt-free future.

Closing a credit card can feel like progress, but it may quietly lower your credit score. Learn how utilization, credit age, and timing affect your score before you close an account.

Hidden credit card fees add up fast. Learn how fine print, rising interest rates, and penalty APRs quietly raise your balance and what steps help you protect your budget and explore real debt-relief options.

Divorce does not erase credit cards or loans. Learn how courts divide marital debt, protect your credit, and rebuild your budget so you can move forward with a clearer plan.

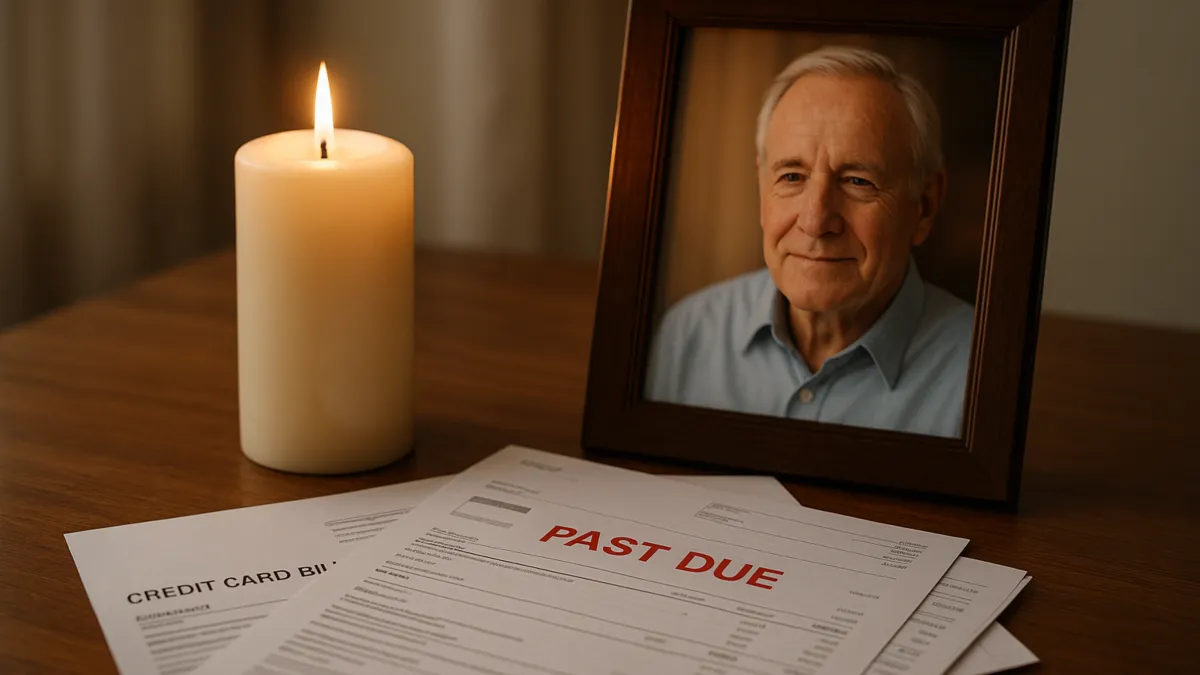

My Debt Navigator explains what happens to your debts after death, such as how estate laws work, who might be responsible, and what you can do now to protect your loved ones.