(888) 311-5439

Speak to a Specialist Right Away

You are not alone. We are here for you!

Debt SOLUTIONS

answers to debt stress —

There’s hope. Solutions are available,

and freedom is possible.

Break the Bad Money Habits

& Build a Better Ones

We’ll help you stop wasting money and start making smart choices.

It all starts with

CLARITY, CATEGORIZE & CHART.

You are not alone. We are here for you!

DEBT SOLUTIONS

answers to debt stress — There’s hope. Solutions are available, and freedom is possible.

It only takes a minute to discover your options

Answer a few quick questions below to get started.

Clarity

Get clarity on your budget, your rights, and your debt. We’ll help you understand where you stand and how to move forward with confidence.

Categorize

Not all debt is the same. We’ll help you sort and prioritize, focusing on the most urgent debts first and finding the right strategies for each.

Chart

Once we’ve established clarity and categorized your debt, we’ll create a personalized plan that guides you toward financial freedom, with clear steps to follow.

It Only Takes a Minute to Help Us Understand Your Situation

Answer a few quick questions below to get started.

Clarity

Get clarity on your budget, your rights, and your debt. We’ll help you understand where you stand and how to move forward with confidence.

Categorize

Not all debt is the same. We’ll help you sort and prioritize, focusing on the most urgent debts first and finding the right strategies for each.

Chart

Once we’ve established clarity and categorized your debt, we’ll create a personalized plan that guides you toward financial freedom, with clear steps to follow.

Reach Out If You Need Help With

You don’t need to stay stuck in confusion, stress, or shame. You deserve to feel in control, to see a path forward, and to live a life of peace and financial freedom.

Reach Out If You Need Help With

You don’t need to stay stuck in confusion, stress, or shame. You deserve to feel in control, to see a path forward, and to live a life of peace and financial freedom.

Credit

Cards

Medical

Bills

Student

Loans

Cash Advance Loans

Commercial

Banks

Credit Cards

Medical Bills

Student Loans

Cash Advance Loans

Commercial Banks

Solar Panels Financing

Merchant Cash Advance

Furniture Loans

Credit Unions Loans

Payday Loans

Business Debts

Time Shares

Department Store Accounts

State & Fed Taxes

Gas Cards

Solar

Panels Financing

Merchant Cash

Advance

Furniture

Loans

Credit

Unions Loans

Payday

Loans

Business

Debts

Time

Shares

Department Store

Accounts

State & Fed

Taxes

Gas

Cards

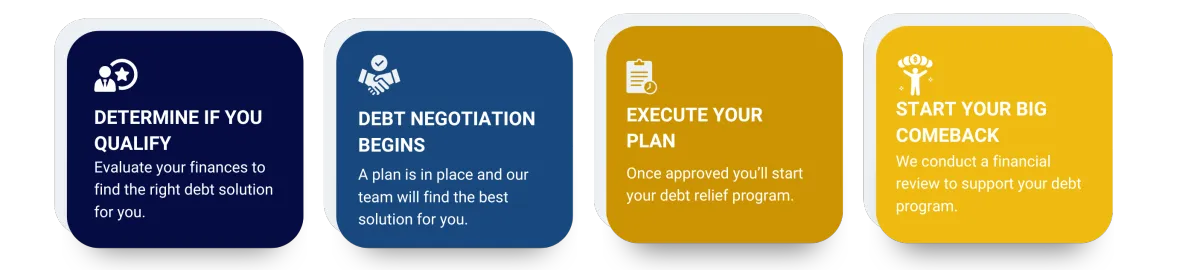

Build a winning Plan That Helps You Save More and Stress Less

Once your debt is organized, we’ll work with you to craft a powerful, personalized plan. You’ll follow clear, actionable steps designed to help you achieve financial peace and a debt-free life.

Build a winning Plan That Helps You Save More and Stress Less

Once your debt is organized, we’ll work with you to craft a powerful, personalized plan. You’ll follow clear, actionable steps designed to help you achieve financial peace and a debt-free life.

Your Comeback Starts Now!

Success begins with a strong will and consistent effort. Every small step brings you closer to your goals.

Believe in yourself, embrace challenges, and never give up.

Start today and turn your dreams into reality!

With our system:

Get CLARITY about your money

CATEGORIZE your debts easily

CHART a clear plan to financial freedom

Our focus is simple:

No complicated tools

No confusing terms

Just clear steps anyone can follow

When you focus on CLARITY, CATEGORIZE & CHART,

everything else falls into place.

Special Focus Programs

🎓 Student Loan Relief

Student loans can feel overwhelming, but you don’t have to face them alone. We’ll help you review your options, including repayment plans and relief programs, and guide you toward a solution that fits your budget and goals.

🧾 Tax Debt Solutions

Settle or reduce back taxes

Stop penalties and garnishments

Negotiate with IRS or state

Create an affordable payment plan

Get expert guidance throughout

With our system:

Get CLARITY about your money

CATEGORIZE your debts easily

CHART a clear plan to financial freedom

Our focus is simple:

No complicated tools

No confusing terms

Just clear steps anyone can follow

Special Focus Programs

🎓 Student Loan Relief

Student loans can feel overwhelming, but you don’t have to face them alone. We’ll help you review your options, including repayment plans and relief programs, and guide you toward a solution that fits your budget and goals.

🧾 Tax Debt Solutions

Settle or reduce back taxes

Stop penalties and garnishments

Negotiate with IRS or state

Create an affordable payment plan

Get expert guidance throughout

Your Comeback Starts Now!

Success begins with a strong will and consistent effort. Every small step brings you closer to your goals.

Believe in yourself, embrace challenges, and never give up.

Start today and turn your dreams into reality!

FREQUENTLY ASKED QUESTIONS

Can My Debt Navigator help me if I’m unsure which financial option is right for me

Absolutely! Our consultation process is designed to help you gain clarity about your financial situation. We take the time to explain all available strategies and help you explore options that align with your goals, empowering you to make informed decisions.

How do we meet?

The initial consultations, unless specifically requested otherwise, are conducted via phone with a licensed specialist. A meeting via Zoom can be requested in advance.

Do all types of debt apply?

It’s best to schedule a call with a specialist. Each case is unique, and the specialist can provide guidance based on your specific situation.

How quickly can I see results after working with My Debt Navigator?

The timeline for results depends on your specific circumstances and the strategy you choose. While some clients see initial progress within a few days, our primary focus is to ensure you have a sustainable and effective plan for long-term financial health.

I have collectors calling me daily. Can you help?

Yes, we can assist in stopping any harassment by creditors.

What makes My Debt Navigator different from other debt relief services?

At My Debt Navigator, we don’t just offer generic solutions. Our specialists focus on understanding your unique financial situation and tailoring strategies that best fit your needs. Many of our specialists are licensed and bring years of experience, ensuring you receive knowledgeable and personalized guidance.

Does My Debt Navigator provide ongoing support after the initial consultation?

Yes! Our team remains available to answer questions and provide additional guidance throughout your journey. If needed, we can also connect you with our trusted network of service providers for further assistance.

Is there a charge for the consultation?

No, there is no charge for the initial consultation.

What do I need to have for the appointment?

You don’t need to have anything specific prepared, but it can be helpful to have statements available. If not, the specialist can assist you by going through your listed liabilities to determine your options and create a customized strategy.

Is My Debt Navigator’s consultation process confidential?

Yes, your privacy is our priority. All consultations are handled with the utmost confidentiality, ensuring your financial information is protected. We are committed to maintaining trust and transparency in every interaction.

FREQUENTLY ASKED QUESTIONS

Can My Debt Navigator help me if I’m unsure which financial option is right for me

Absolutely! Our consultation process is designed to help you gain clarity about your financial situation. We take the time to explain all available strategies and help you explore options that align with your goals, empowering you to make informed decisions.

What makes My Debt Navigator different from other debt relief services?

At My Debt Navigator, we don’t just offer generic solutions. Our specialists focus on understanding your unique financial situation and tailoring strategies that best fit your needs. Many of our specialists are licensed and bring years of experience, ensuring you receive knowledgeable and personalized guidance.

Does My Debt Navigator provide ongoing support after the initial consultation?

Yes! Our team remains available to answer questions and provide additional guidance throughout your journey. If needed, we can also connect you with our trusted network of service providers for further assistance.

How quickly can I see results after working with My Debt Navigator?

The timeline for results depends on your specific circumstances and the strategy you choose. While some clients see initial progress within a few days, our primary focus is to ensure you have a sustainable and effective plan for long-term financial health.

Is My Debt Navigator’s consultation process confidential?

Yes, your privacy is our priority. All consultations are handled with the utmost confidentiality, ensuring your financial information is protected. We are committed to maintaining trust and transparency in every interaction.

Is there a charge for the consultation?

No, there is no charge for the initial consultation.

How do we meet?

The initial consultations, unless specifically requested otherwise, are conducted via phone with a licensed specialist. A meeting via Zoom can be requested in advance.

What do I need to have for the appointment?

You don’t need to have anything specific prepared, but it can be helpful to have statements available. If not, the specialist can assist you by going through your listed liabilities to determine your options and create a customized strategy.

Do all types of debt apply?

It’s best to schedule a call with a specialist. Each case is unique, and the specialist can provide guidance based on your specific situation.

I have collectors calling me daily. Can you help?

Yes, we can assist in stopping any harassment by creditors.

I am already being sued by a creditor. Can you help?

We can assist in many situations. Please set up an appointment to discuss your specific case further.

Real Stories from Real People

Real Stories from Real People

Disclaimer: My Debt Navigator acts solely as a referral affiliate for various debt settlement programs and does not provide these services directly. My Debt Navigator makes no guarantees or warranties, express or implied, regarding the outcomes or results of any debt settlement program. Participation in such programs should not be considered a substitute for professional financial, legal, or tax advice. By using these services, it is your responsibility to read, understand, and agree to the terms and conditions of the program you enroll in. You should ensure that any program is suitable for your specific circumstances. My Debt Navigator does not assume any debts, make monthly payments to creditors, or provide tax, bankruptcy, accounting, legal advice, or credit repair services. We are not a lending institution, creditor, or debt collector. Availability of our services may vary based on state laws and regulations, and fees may also vary accordingly. We highly recommend consulting with a tax professional to understand the potential tax implications of less-than-full balance debt resolution. Please be aware that participation in debt settlement services can adversely affect your credit score, may lead you to be subject to collections, and in some cases, you may be sued by creditors or collectors. My Debt Navigator is indemnified of any liability for the actions and results of the carriers and acts solely as a referral affiliate. We strongly recommend that all materials and disclosures relating to the debt settlement program are thoroughly read and understood before enrollment. Your use of these services signifies your understanding and acceptance of these terms.

Disclaimer: My Debt Navigator acts solely as a referral affiliate for various debt settlement programs and does not provide these services directly. My Debt Navigator makes no guarantees or warranties, express or implied, regarding the outcomes or results of any debt settlement program. Participation in such programs should not be considered a substitute for professional financial, legal, or tax advice. By using these services, it is your responsibility to read, understand, and agree to the terms and conditions of the program you enroll in. You should ensure that any program is suitable for your specific circumstances. My Debt Navigator does not assume any debts, make monthly payments to creditors, or provide tax, bankruptcy, accounting, legal advice, or credit repair services. We are not a lending institution, creditor, or debt collector. Availability of our services may vary based on state laws and regulations, and fees may also vary accordingly. We highly recommend consulting with a tax professional to understand the potential tax implications of less-than-full balance debt resolution. Please be aware that participation in debt settlement services can adversely affect your credit score, may lead you to be subject to collections, and in some cases, you may be sued by creditors or collectors. My Debt Navigator is indemnified of any liability for the actions and results of the carriers and acts solely as a referral affiliate. We strongly recommend that all materials and disclosures relating to the debt settlement program are thoroughly read and understood before enrollment. Your use of these services signifies your understanding and acceptance of these terms.